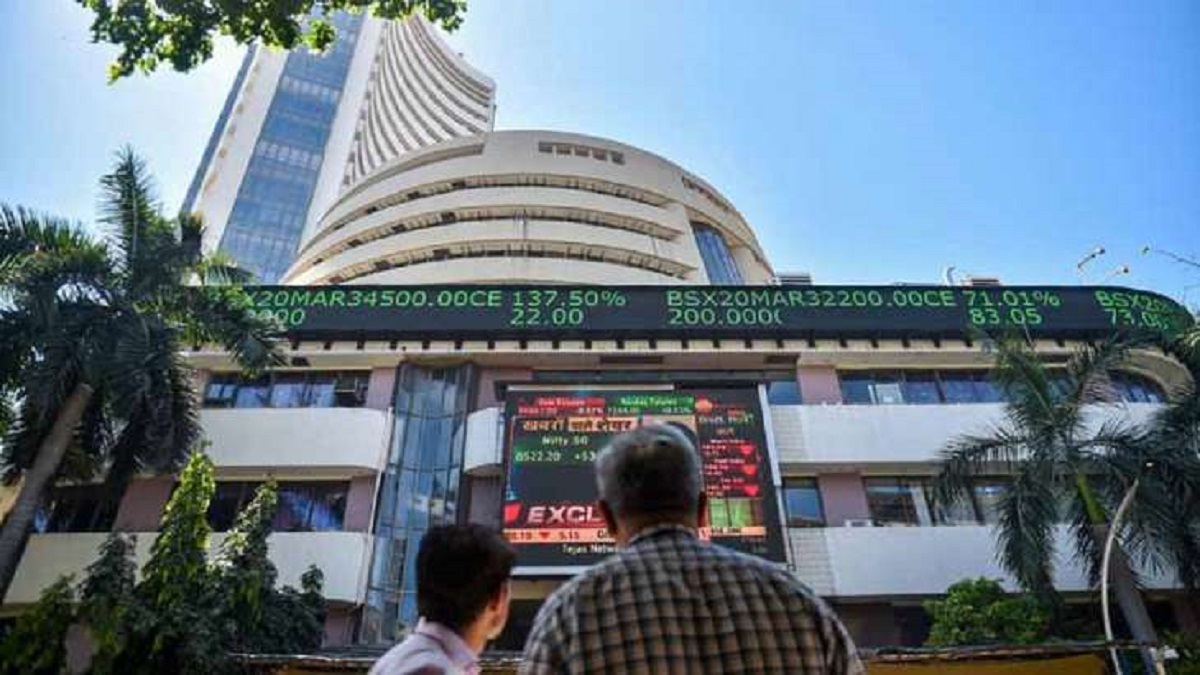

As investors continued to remain optimistic about the domestic markets, equity benchmark indices extended their rally for the seventh day running on Monday. Buying in index majors Reliance Industries and Tata Consultancy Services also added to the winning momentum in equities. The 30-share BSE Sensex climbed 293.7 points to 66,892.61 in early trade. The Nifty advanced 95 points to 19,914.95.

Among the Sensex firms, HCL Technologies, Maruti, State Bank of India, Tata Consultancy Services, Tata Motors, Wipro, Nestle, Reliance Industries, Larsen & Toubro and UltraTech Cement were the major gainers. IndusInd Bank and Bharti Airtel were the laggards.

How did Asian and US markets fare?

In Asian markets, Shanghai quoted with gains while Seoul, Tokyo and Hong Kong traded lower. The US markets ended in positive territory on Friday. Global oil benchmark Brent crude declined 0.18 per cent to USD 90.49 a barrel. The BSE benchmark had jumped 333.35 points or 0.50 per cent to finish at 66,598.91 on Friday. The broader Nifty advanced 92.90 points or 0.47 per cent to settle at 19,819.95.

In the present favourable market mood, Nifty is likely to make another attempt at a record high trying to conquer the psychological mark of 20,000, Vijayakumar said adding that however, investors have to be cautious since fundamentals do not support a sustained rise above 20,000. Foreign Institutional Investors (FIIs) offloaded equities worth Rs 224.22 crore on Friday, according to exchange data.

Rupee gains against dollar

The rupee continued its upward trend for the second straight session and appreciated by 9 paise to 82.93 against the US dollar in early trade on Monday, tracking positive cues from domestic equity markets and a weak American currency against major overseas rivals.

However, firm crude oil prices hovering above USD 90 per barrel and outflow of foreign funds weighed on the Indian currency, forex traders said.

At the interbank foreign exchange, the domestic unit opened 9 paise higher at 82.93 and traded in a narrow range of 82.90 to 82.96 against the greenback. On Friday, the rupee closed at 83.02 against the US dollar.

(With inputs from PTI)

ALSO READ: India's GDP growth in Q1 FY24 to exceed RBI's estimate of 8%, say economists