New Delhi: The Reserve Bank of India today slashed repo rates, the level at which it lends to commercial banks, by 25 basis points to 7.75 per cent with immediate effect. While it will certainly add to the growth momentum of the Asia's third-largest economy, for borrowers and industry this means cheaper loans, in turn boosting the consumer demand.

With the RBI reducing the benchmark repo rate, home and auto loans are expected to get cheaper. Experts say if the banks pass the benefits of this rate cut move to consumers then it will lower the Equated Monthly Installment (EMI) on the floating rate home loans.

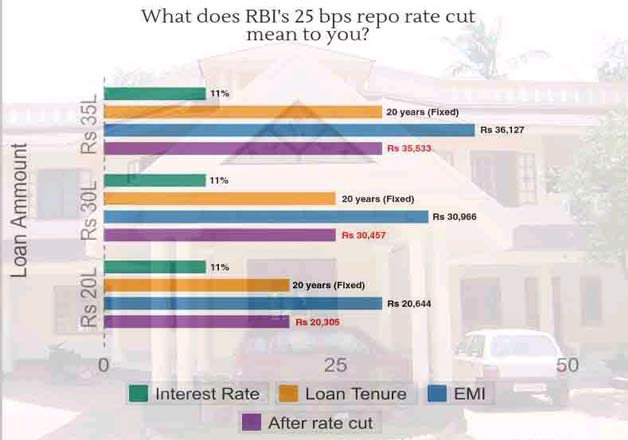

For instance, a home loan of Rs 30 lakh for tenure of 20 years, charges an EMI of Rs 30,966 at 11 per cent interest rate. A fall in interest rate by 25 basis points to 10.75 per cent would reduce the EMI to Rs 30,457.

Experts believe that PSU banks will certainly pass o the benefits of low rate of interest to their customers. And already, United Bank of India has announced a similar 25 basis points drop in its base rate. The base interest rate of the bank now stands at 10 per cent.

Moreover, India's largest bank, State Bank of India (SBI) has already indicated a rate cut. HDFC Bank, too, has intimated the same.

For India Inc, the surprise rate cut would means that banks and non-banking financial companies will now have more cash to lend.

The Ministry of Finance, in a statement, said, "The 25 basis point Report Rate cut announced by the Reserve Bank of India (RBI) is a welcome move and consistent with strong and ongoing disinflationary trends identified in the Ministry's Mid Year Economy Analysis presented to the Parliament last month." The Ministry stated that this is a significant move in signaling a shift in stance and direction for policy going forward, as the RBI's statement has noted.

"This move will provide a fillip to the economy directly by increasing the private sector's ability and willingness to spend. It should also help indirectly by improving balance sheet of the Corporate Sector and banks, facilitating an increase in the demand for and supply of credit," The finance ministry said.

The Ministry further states that along with other policy actions already taken by the Government and other that are under its consideration, this move represents one more step towards reviving investment and realizing India's medium term growth potential.

"The RBI decision to cut the interest rate will lead to more money in the hands of the consumer for greater spending. It is positive for the Indian economy and it will certainly help in reviving the investment cycle the government is trying to restore," said Jaitley who has been nudging the central bank to ease the interest rate to lower the cost of capital.

The Ministry further states that along with other policy actions already taken by the Government and other that are under its consideration, this move represents one more step towards reviving investment and realizing India's medium term growth potential.