Amid Coronavirus pandemic, people are not able to get out of their houses as a nation-wide lockdown has been imposed. While all the banks are now closed, people are still looking to manage their finances. Most banks now have an Android and iOS app that allows users to manage their finances and do things that go further than that. State Bank of India has an application called SBI YONO app for this.

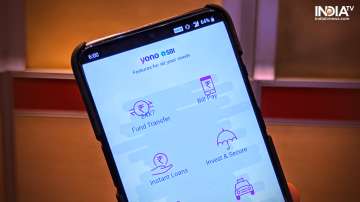

YONO here stands for You Only Need One and by this, the company means that once you join the app, you will need only one app to do all the things you want. It brings tons of benefits like 24/7 fund transfers, instant loans, booking related to travel and entertainment and much more.

With the help of the new YONO app, the company aims to remove debit cards from its customer’s pockets. It instead aims for a digital future where users can just use an app in order to withdraw cash. Apart from withdrawing cash at ATMs, the application aims to solve other problems like shopping, booking tickets and more.

How to download SBI YONO app?

- Head over to the Google Play Store or Apple App Store on your Android or iOS device respectively.

- Search for “YONO SBI” and download the app named “YONO SBI: The Mobile Banking and Lifestyle App!”

- Once downloaded, open the app and it will greet you with the set of features it has on offer

- If you are an existing customer, tap on the Existing customer tab else tap on the “New to SBI” option.

- Existing SBI customers can log in using their Intenet Banking credentials or using the registered ATM card. They can even register for YONO by providing complete account details. New customers, on the other hand, will need to fill a form.

Once you have set up the whole application, you will even get an option to provide an M-PIN, which can be any 4-digit numerical password. This will be required every time one tries to access the application.

What can one do on the YONO app?

YONO app can be used for a lot of things. First, the user can keep a track of his account balance using this application. Not only the savings account balance will be visible, but the user will also be able to access linked credit card details. Further, the app can be used to transfer money from one account to the other. It even allows users to pay bills, recharge their mobile and a lot more.

Apart from that, customers will also be able to apply for a loan using the app. Users can even make investments like Fixed Deposits and Recurring Deposits almost instantly.

In order to attract more users, the company is not only providing banking facilities but also other advantages. These advantages include ticket booking and shopping online. The bank is also providing special discounts and cashback offers for users who shop using the YONO app.

Latest Technology News