Enter the dragon – Chinese entrenchment proving costly for Maldives

The term of current President Ibrahim Solih comes to an end in 2023 and this propaganda campaign aimed at India appears to be an early manifestation of the election strategy of the opposition coalition

The recent acquittal of former Maldivian President Abdulla Yameen in the million dollar money laundering conviction surely does complicates matters for India Maldives relations. The unanimous verdict of a three judge bench of the Supreme Court removes the disqualification on Abdulla Yameen from contesting in presidential election scheduled in 2023. In his speech at a PPM-PNC rally, Yameen has claimed full ownership of the ‘India Out’ campaign that seeks ouster of Indian military personnel from Maldivian soil. The term of current President Ibrahim Solih comes to an end in 2023 and this propaganda campaign aimed at India appears to be an early manifestation of the election strategy of the opposition coalition. By attempting to sway the tech savvy educated class with the aid of an Islamist Nationalist political agenda centered on anti-India rhetoric, the strategy of the pro Chinese PPM-PNC coalition seems clear. Through a sustained spread of xenophobia, hate and mistrust, it seeks to sweep aside its own misdeeds when it was in power under the previous regime. The end state is to subvert the young democracy and lead it into the arms of a waiting Dragon.

That the Yameen led opposition party is again dancing to the tunes of Chinese is not something new. It bears mention that the 2013 elections was preceded by a similar anti-India campaign and to some extent helped Abdulla Yameen come into power. Immediately after that, we saw the first ever visit by a Chinese head of state to Maldives. The Chinese investment boom in the Maldives also got under way soon after and included a Maldives Ministry of Foreign Affairs building, a national museum, housing projects, expansion of the airport, and various investments in renewable energy, tourism and telecommunications. Maldivian finance ministry data show that well over USD 1 billion in loans were agreed in the four years after Xi’s visit, all either borrowed directly or guaranteed by the Maldivian government. Chinese state companies lent USD 547.9 million to fund the construction of 11,000 apartments in high-rise blocks that would be built in the second phase of development of Hulhumale island. They lent a further USD 180.9 million for work to extend the electricity grid to the new island and USD 421 million to expand the airport serving Male and Hulhumale. The most celebrated project was the USD 210 million Friendship Bridge, funded mostly by a USD 126 million Chinese government grant and a USD 68 million loan from Export Import Bank of China. Further, against normal business sense, large commercial loans to private institutions/ business men were given on sovereign guarantee. The five years from 2014 to 2019 left Maldives in a Chinese debt trap, a state of emergency, as well as large scale human rights violations including targeted killing of journalists who dared to expose the situation on ground.

The Chinese debt trap has cast a shadow over Maldivian economy with some estimates suggesting that the island nation currently owes as much as USD 3.1 billion to Beijing which is almost equal to 60 percent of her GDP. The figure includes government to government loans, money given to state enterprises and private sector loans guaranteed by the Maldivian government. The current Speaker of Maldivian Parliament, Mohamed Nasheed, believes that his country has walked into a debt trap considering that the business plan of none of these projects, funded by Chinese investment, indicate viability to generate enough profit to pay back the loan. Former Maldivian officials and Chinese representatives put the figure, Male owes China, between USD 1.1 to 1.4 billion which itself is a huge sum for a country with a GDP of only USD 4.9 billion. The discrepancy in the actual debt owed by Maldives has been a result of the lack of transparency with which the contracts were formalised leaving the current Maldivian administration struggling to arrange payment for these loans.

Nasheed worries that Maldives could meet the same fate as Sri Lanka where Chinese debt trap led to a Chinese state-run enterprise acquiring a 70 per cent stake in the Hambantota port on a 99 year lease in 2017. The fears of the Maldivian Governments came true in Jul 20 when China’s Exim Bank asked the Maldivian government to pay USD 10 million (MVR 154 million), when Ahmed Siyam, former parliamentarian and owner of Sun Siyam Resorts Pvt Ltd, defaulted on loan repayment for the USD 127 million loan secured under the previous administration with sovereign guarantee. While the previous government issued over MVR 9 billion in sovereign guarantees, Sun Siyam Resorts Pvt Ltd was the only private company to have received such a grant. The facility of “sovereign guarantee” is generally available only to government institutions/ State-owned enterprises and the guarantor state has to repay the loan with interest in case of default. If the present Solih government refuses to pay up, it could affect the state’s credibility in global credit-markets. On the contrary, such repayment of a private debt can devalue the Maldivian Rufiyaa and impact its foreign trade and forex reserves.

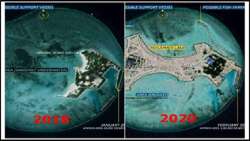

The former President Abdulla Yameen had also brought in a controversial land acquisition law in 2015 which allowed foreigners to own land in perpetuity, if they invested more than USD 1 Billion and reclaimed 70% of it from the sea. The move by the then pro-China government fuelled concern that foreign powers could use such land for military purposes. Even though the law was repealed by the Maldives parliament in 2019, reports suggest that Chinese developers have leased up to 17 islands prior cancellation of the controversial law. One just needs to study the massive facelift the Chinese leased Maldivian island of Feydhoo Finolhu has undergone, to realise the Chinese entrenchment in Maldives. The island, which is just 684 km from India, was leased until 2066 by China from the Maldivian government for a paltry USD 4 million. Since 2018, the island has witnessed a dramatic increase in size from 38,000 sq. metres to 1,00,000 sq. meters and is undergoing rapid construction as well. The construction on this island as well as the face-lift mirrors Chinese actions on the Spratly Islands in the South China Sea. Fears of China utilising these leased islands for military purposes cannot be wished away.