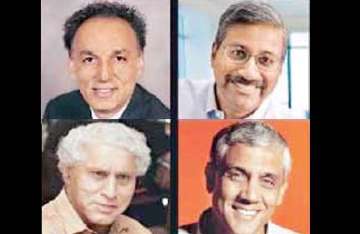

Four Indian-Americans Among 400 Richest People In US

Four Indian-Americans, including Sun Microsystems co- founder Vinod Khosla, are among Forbes 400 Richest People in US, a list topped by Microsoft's Bill Gates, reports Delhi tabloid Mail Today. Apart from Khosla, those who made

Four Indian-Americans, including Sun Microsystems co- founder Vinod Khosla, are among Forbes 400 Richest People in US, a list topped by Microsoft's Bill Gates, reports Delhi tabloid Mail Today.

Apart from Khosla, those who made the cut include outsourcing firm Syntel's founder Bharat Desai, venture capitalist Kavitark Ram Shriram and software king Romesh Wadhwani.

While Khosla occupies the 308th spot in the list with a fortune worth $ 1.3 billion, Desai ranks 252 with a networth of $ 1.6 billion.

Shriram occupies the 288th position with assets worth $ 1.45 billion and Wadhwani is on the 290th spot in this year's list with a total valuation of $ 1.4 billion.

The list is topped by Gates, who has retained his position as the richest man in the US with a networth of $ 54 billion, for the 17th year in a row.

Desai earned his engineering degree from IIT Mumbai and moved to the US after landing a programming job with Tata Consultancy Services ( TCS) in 1976.

He founded outsourcing outfit Syntel in 1980 with wife Neerja Sethi, while earning his MBA from the University of Michigan.

Although he stepped down as CEO last year, Desai remains the chairman.

The Florida resident launched a deep value hedge fund last year and recently established a foundation supporting entrepreneurship and education.

Desai played for India in the 1994 bridge world championship and says his biggest failure is not being able to play cricket for India.

Shriram is the founding board member of Google and one of the first investors in the company.

Shriram was one of the first to write a cheque to Google co- founders Sergey Brin and Larry Page in 1998.

He would advise them one day a week in their Menlo Park garage, Forbes magazine said. The University of Madras alumnus is still a board member and large shareholder of the search giant.

The California- resident is now running his own investment firm, Sherpalo Ventures, which has big stakes in online outsourcer 24/ 7 Customer.

It has also invested recently in Inkling, which makes interactive textbooks for the iPad. Born in India, he joined Netscape in 1994. His next company, Junglee, was bought by Amazon in 1998.

The 53- year- old was elected Stanford University trustee last December. Wadhwani is founder, chairman and chief executive officer ( CEO) of Symphony Technology Group, a private equity ( PE) firm investing in software and software services firms.

An IIT Mumbai alumnus, Wadhwani moved to the US in 1969 and earned a PhD in electrical engineering at Carnegie. He founded software firm Aspect in 1991 and rode the tech bubble onto The Forbes 400 list in 1999 with the $ 9.3 billion sale of Aspect Development software firm to i2 Technologies.

Silicon Valley venture capitalist Khosla co- founded Sun Microsystems in 1982.

SKS, the Indian microfinance lender he backed in 2006, went public in August. He joined Sun investor John Doerr at Kleiner Perkins Caufield & Byers in 1996 and started Khosla Ventures in 2004.

His firm raised $ 1.1 billion in 2009, the most by a venture firm in three years. An avid- skydiver and hand glider, the 55- year- old is an IIT alumnus and his Three Dog Vineyards, named after his dogs, produces a thousand bottles of Cabernet Sauvignon a year.

The list also includes the likes of Warren Buffett, CEO, Berkshire Hathaway Inc; Bill Gates, chairman, Microsoft Corp; Larry Ellison, co- founder and CEO, Oracle; Mark Zuckerberg, founder and CEO, Facebook; Steve Jobs, cofounder and CEO, Apple Inc and media mogul Oprah Winfrey.

Forbes said the net worth of its rich list climbed eight per cent this year to $ 1.4 trillion compared to $ 1.27 trillion last year. Wealth rose for 217 members of the list, while 85 saw a decline. It also said that 16 new members joined the list this year, courtesy inheritance, appreciation and big buyouts.

However, 34 people fell off the list in 2010, including Raj Rajaratnam, founder of the Galleon Group hedge fund. The top- 10 on the list gained $ 24.9 billion. The price of admission to the list is back up to $ 1 billion from 2009, when $ 950 million was enough to make it to the top 400.

Apart from Khosla, those who made the cut include outsourcing firm Syntel's founder Bharat Desai, venture capitalist Kavitark Ram Shriram and software king Romesh Wadhwani.

While Khosla occupies the 308th spot in the list with a fortune worth $ 1.3 billion, Desai ranks 252 with a networth of $ 1.6 billion.

Shriram occupies the 288th position with assets worth $ 1.45 billion and Wadhwani is on the 290th spot in this year's list with a total valuation of $ 1.4 billion.

The list is topped by Gates, who has retained his position as the richest man in the US with a networth of $ 54 billion, for the 17th year in a row.

Desai earned his engineering degree from IIT Mumbai and moved to the US after landing a programming job with Tata Consultancy Services ( TCS) in 1976.

He founded outsourcing outfit Syntel in 1980 with wife Neerja Sethi, while earning his MBA from the University of Michigan.

Although he stepped down as CEO last year, Desai remains the chairman.

The Florida resident launched a deep value hedge fund last year and recently established a foundation supporting entrepreneurship and education.

Desai played for India in the 1994 bridge world championship and says his biggest failure is not being able to play cricket for India.

Shriram is the founding board member of Google and one of the first investors in the company.

Shriram was one of the first to write a cheque to Google co- founders Sergey Brin and Larry Page in 1998.

He would advise them one day a week in their Menlo Park garage, Forbes magazine said. The University of Madras alumnus is still a board member and large shareholder of the search giant.

The California- resident is now running his own investment firm, Sherpalo Ventures, which has big stakes in online outsourcer 24/ 7 Customer.

It has also invested recently in Inkling, which makes interactive textbooks for the iPad. Born in India, he joined Netscape in 1994. His next company, Junglee, was bought by Amazon in 1998.

The 53- year- old was elected Stanford University trustee last December. Wadhwani is founder, chairman and chief executive officer ( CEO) of Symphony Technology Group, a private equity ( PE) firm investing in software and software services firms.

An IIT Mumbai alumnus, Wadhwani moved to the US in 1969 and earned a PhD in electrical engineering at Carnegie. He founded software firm Aspect in 1991 and rode the tech bubble onto The Forbes 400 list in 1999 with the $ 9.3 billion sale of Aspect Development software firm to i2 Technologies.

Silicon Valley venture capitalist Khosla co- founded Sun Microsystems in 1982.

SKS, the Indian microfinance lender he backed in 2006, went public in August. He joined Sun investor John Doerr at Kleiner Perkins Caufield & Byers in 1996 and started Khosla Ventures in 2004.

His firm raised $ 1.1 billion in 2009, the most by a venture firm in three years. An avid- skydiver and hand glider, the 55- year- old is an IIT alumnus and his Three Dog Vineyards, named after his dogs, produces a thousand bottles of Cabernet Sauvignon a year.

The list also includes the likes of Warren Buffett, CEO, Berkshire Hathaway Inc; Bill Gates, chairman, Microsoft Corp; Larry Ellison, co- founder and CEO, Oracle; Mark Zuckerberg, founder and CEO, Facebook; Steve Jobs, cofounder and CEO, Apple Inc and media mogul Oprah Winfrey.

Forbes said the net worth of its rich list climbed eight per cent this year to $ 1.4 trillion compared to $ 1.27 trillion last year. Wealth rose for 217 members of the list, while 85 saw a decline. It also said that 16 new members joined the list this year, courtesy inheritance, appreciation and big buyouts.

However, 34 people fell off the list in 2010, including Raj Rajaratnam, founder of the Galleon Group hedge fund. The top- 10 on the list gained $ 24.9 billion. The price of admission to the list is back up to $ 1 billion from 2009, when $ 950 million was enough to make it to the top 400.