India TV Fact Check: As the window for filing Income Tax Returns (ITR) for FY23 ended on July 31, several taxpayers who have paid extra income tax and were anticipating a tax refund are receiving messages notifying them about the refund amount they will be receiving.

How accurate is this viral message? In today's Fact Check Story, we will investigate whether taxpayers will receive the money or not. We will see what the Income Tax Department has to say about this.

Claim

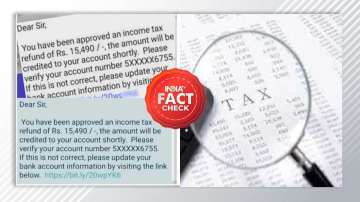

A message is doing rounds and has gone viral claiming that taxpayers have received an income tax refund of Rs 15,490. "You have been approved a tax refund of Rs 15,490 and the amount will be credited to your account number 5xxxxx6755. If this is not correct please update your bank account information by visiting the link below," the message reads.

Viral message

Truth

When we received this photo through WhatsApp, we began our investigation and found that the viral message was fake. PIB Fact Check, a fact-checking unit of the Press Information Bureau, has also issued a clarification in this regard so that taxpayers don't fall for hoax IT refund scams. It asked people to beware of such scams and refrain from sharing their personal information.

It is pertinent to mention that as per government rules, the Income Tax department sends the refund after the IT return is duly processed. The Income Tax Department has warned that taxpayers should not click on such fake messages or open any attachments.

Income Tax Guidelines

According to the Income Tax, “If you receive an e-mail or find a website you think is pretending to be of Income Tax Department, forward the e-mail or website URL to webmanager@incometax.gov.in. A copy may also be forwarded to incident@cert-in.org.in. You may forward the message as received or provide the Internet header of the e-mail. The Internet header has additional information to help us locate the sender. After you forward the e-mail or header information to us, delete the message.”

"If you receive an e-mail from someone claiming to be the authorized by Income Tax Department or directing you to an Income Tax website, do not reply. Do not open any attachments. Attachments may contain malicious code that will infect your computer. Do not click on any links. If you clicked on links in a suspicious e-mail or phishing website then do not enter confidential information like bank account, credit card details," the Income Tax department said.

July 31 was the last date for filing income tax returns by salaried taxpayers and those who do not need to get their accounts audited for income earned in the 2022-23 fiscal. A record 6.77 crore income tax returns for the Assessment Year 2023-24 were filed till July 31 this year, including 53.67 lakh first-time payers. It further stated that July's income tax returns are 16.1 per cent more than the total ITRs for Assessment Year 2022-23.