RBI keeps repo rate unchanged at 4% for 10th time in a row; FY23 GDP growth pegged at 7.8%

This is the tenth consecutive time since the rate remains unchanged. The central bank had last revised the policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

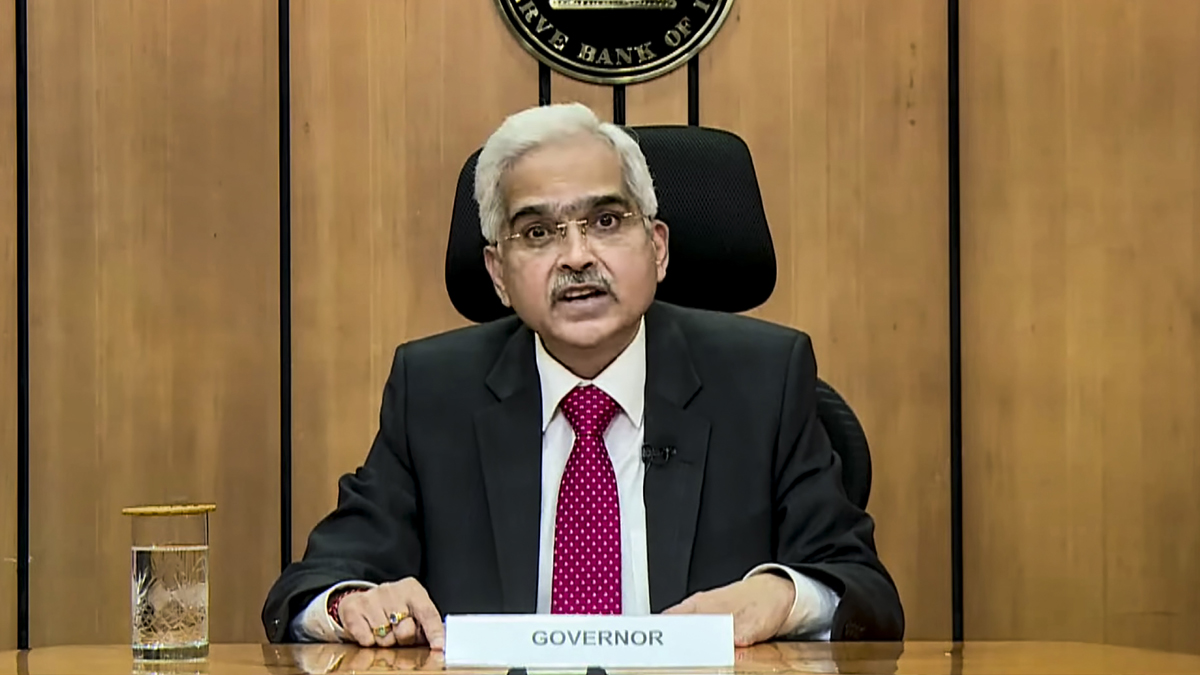

Reserve Bank Governor Shaktikanta Das headed six-member Monetary Policy Committee (MPC) on Thursday decided to maintain the status quo on the benchmark interest rate or repo rate. With this, the repo rate remains at 4 per cent and reverse repo rate at 3.35 per cent. This was the first MPC meeting after presentation of Budget 2022-23 in Parliament on February 1.

This is the tenth consecutive time since the rate remains unchanged. The central bank had last revised the policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting the interest rate to a historic low.

Das said MPC voted unanimously for keeping interest rate unchanged and decided to continue with its accommodative stance as long as necessary to support growth and keep inflation within the target.

RBI retained its growth projection at 9.2 per cent and inflation at 5.3 per cent for the current financial year. For the next fiscal, the cental bank projected GDP growth at 7.8 per cent.

"Real GDP growth of 9.2 per cent in FY22 will take economy above pre-pandemic level," the RBI Governor said, adding that India is charting a different course of recovery than the rest of the world and the country would emerge as the fastest growing economy.

Retail inflation rose to a five-month high of 5.59 per cent in December from 4.91 per cent in November, mainly due to an uptick in food prices. MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2026, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent.

The last MPC held in December 2021 had kept the benchmark interest rate unchanged at 4 per cent and decided to continue with its accommodative stance against the backdrop of concerns over the emergence of the new coronavirus variant Omicron. The MPC has also been tasked by the government to keep inflation in the range of 2-6 per cent.