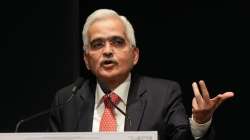

'Initiatives taken to make UPI system available on feature phones', says RBI Governor

The UPI was started in September 2016 and then after the growth has been very steady and now it has crossed 10 billion.

Shaktikanta Das, the Governor of the Reserve Bank of India (RBI) asserted that steps have been taken to make keypad mobile phones also operate the UPI payment system. While addressing a program at Devi Ahilya Vishwavidyalaya (DAVV) in Madhya Pradesh’s Indore district on Friday, he also said that he was sharing information in his central board meeting that the number of transactions for the month in the UPI exceeded 10 billion in the month of August.

“The UPI payment system has been recognised as a great success internationally. It is one of the initiatives of the Reserve Bank with the solid support of the government. Without their support, it would have not been possible. With the support of the government, RBI has been able to make the UPI the largest payment system in the world,” the RBI governor said.

He also said that he was sharing information in his central board meeting on Friday that the number of transactions for the month in the UPI exceeded 10 billion in the month of August.

The UPI was started in September 2016 and then after the growth has been very steady and now it has crossed 10 billion. But that's not enough, it will grow further.

“We have encouraged digital payment but the main challenge on the UPI is that it usually needs a smartphone but in our country, a large number of people are using feature phones. We have launched some products to make feature phones to operate the UPI system as well. We have also taken steps to ensure that in areas where there is poor connectivity a wallet kind of facility through which one can make transactions on the UPI,” he added.

“We are also among the few countries that have actually launched a pilot project on CBDC (Central Bank Digital Currency) that is e-rupee. It is nothing but just like paper currency and it is a digital unit of the currency. The pilot project is already in operation and a lot of trials are going on,” Governor Das further said.

(with inputs from ANI)

ALSO READ | RBI says 93% of Rs 2,000 notes worth Rs 3.32 lakh crore back with banks

ALSO READ | Multibagger stock: RBI-registered NBFC to sale stake in realty major as financial sector grows