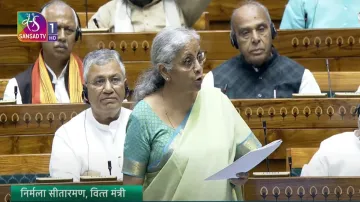

Finance Bill 2024: Union Finance Minister Nirmala Sitharaman today (August 7) said the contentious Long Term Capital Gains (LTCG) tax proposal on real estate is being amended to give the option to taxpayers to compute tax liability under the old system or at reduced rates without indexation, and pay the lower of the two.

Replying to a debate on the Finance Bill in Rajya Sabha on Wednesday, FM Nirmala Sitharaman said the rollover benefit will be available to taxpayers who buy new immovable property utilising the capital gains on the sale of old property.

The Budget 2024-25 proposal to remove indexation benefit in calculation of long term capital gains on the sale of immovable properties evoked sharp criticism from various corners, including opposition parties and tax professionals.

Lower rate of LTCG tax in earlier Budget

The Budget, presented on July 23 (Tuesday), had proposed a lower 12.5 per cent rate of LTCG tax, down from 20 per cent, while doing away with the indexation benefit. The major amendment in the Bill relates to restoration of indexation benefit on sale of properties bought prior to July 23, 2024.

Now, individuals or HuFs who bought houses before July 23, 2024, can opt to pay LTCG tax under the new scheme at the rate of 12.5 per cent without indexation or claim the indexation benefit and pay 20 per cent tax.

Sitharaman said that the indexation benefit was proposed to be removed in the Budget to bring all asset classes under one rate and not to enhance revenue.

Govt raised standard deduction for salaried employees

Replying to the opposition members who repeatedly accused the government of burdening taxpayers both through direct and indirect taxes, she said that government has raised standard deduction for salaried employees, increased the limit of exemption of capital gains on certain listed financial assets and abolished angel tax.

"Standard deduction for salaries employees has also been increased from Rs 50000 to Rs 75000 in the new regime in this budget. This is an effective relief up to Rs 17,500 for a salaried employee," she said.

"In 2023, the slabs for personal income tax were significantly liberalised. All tax payers had reduced tax liability of Rs 37,500. This govt has again revised slabs in the new regime," she added.

The minister said that these steps will benefit the middle class. For the benefit of the lower and middle-income classes, Sitharaman in her Budget speech on July 23 proposed to increase the limit of exemption of capital gains on certain listed financial assets from Rs 1 lakh to Rs 1.25 lakh per year.

Opposition slams govt: 'Finance Bill should be renamed as tax trap bill'

The opposition today accused the Centre of indulging in "tax terrorism", alleging that the Finance Bill should be renamed as "tax trap bill" and a "reverse Robin Hood" syndrome was prevailing under the Modi government.

Robin Hood was a legendary outlaw in English folklore who stole from the rich and gave to the poor. Participating in the debate on the Finance Bill, Trinamool Congress MP Kalyan Banerjee said there is no doubt that the country is the fastest growing economy in the world, but the poor people of India are not getting its benefits.

Banerjee said there is no clear mention about the unorganized sector in the bill and about ending the unemployment crisis. He asserted that it is very important to find a permanent solution to this problem.

The TMC member said that nothing has been said about the unorganized sector in the Finance Bill, while 92 per cent of India's workers work in the unorganised sector. "Another problem is that contractors are appointed, workers are appointed through them. When the contractor's service ends, the workers also become unemployed. Therefore, the government will have to pay attention to the employment security of the employees," he said.

ALSO READ: Mamata urges Sitharaman to rollback GST on life, health insurance premiums: 'Highly anti-people...'

ALSO READ: 'Tax on life's uncertainties': Gadkari writes to Sitharaman on GST on life insurance premium

Latest Business News