Monetary Policy: RBI keeps repo rate unchanged for 9th time in a row at 6.5 pc

This marks the ninth consecutive time the MPC has held the repo rate at 6.5%, maintaining its stance of 'withdrawal of accommodation' to steer inflation towards the desired target. The decision received majority support, with four out of six members in favour.

The Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6.5%, ensuring no immediate impact on loan EMIs. The Monetary Policy Committee (MPC) aims to guide inflation towards the target while supporting economic growth.

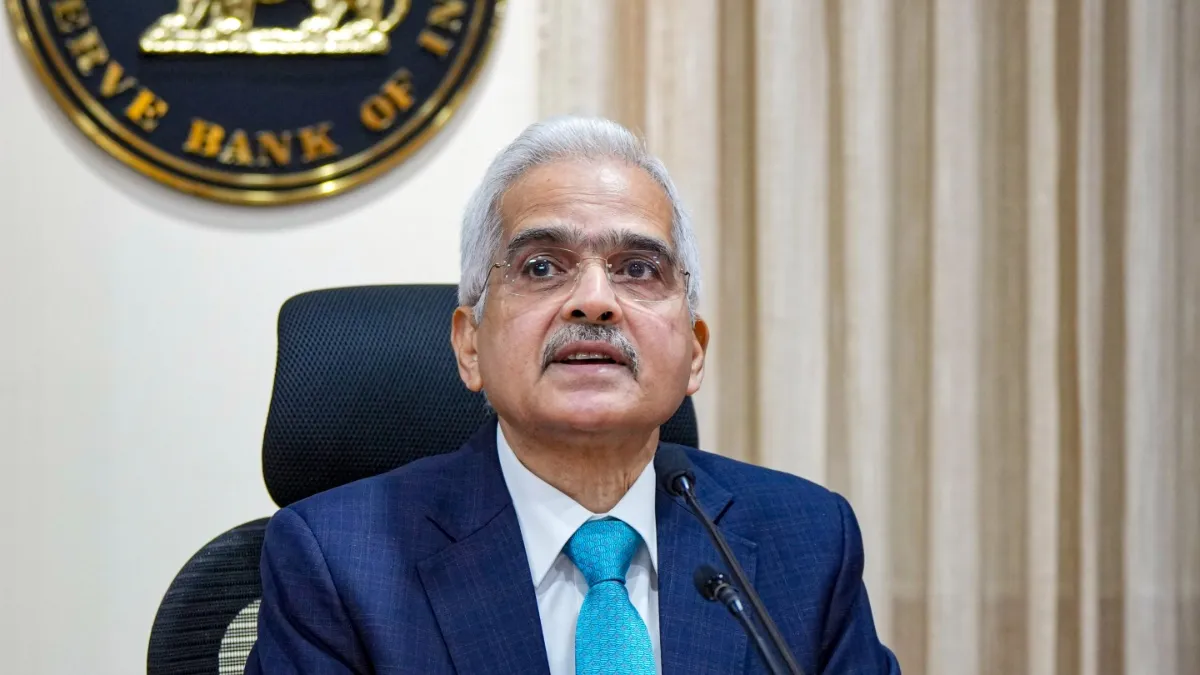

The Reserve Bank of India (RBI) announced on Thursday that the Monetary Policy Committee (MPC) has decided to keep the policy repo rate unchanged at 6.5%. "The MPC decided by a 4:2 majority to maintain the policy repo rate at 6.5%. Consequently, the standing deposit facility (SDF) rate remains at 6.25%, and the marginal standing facility (MSF) rate and the bank rate are at 6.75%," said RBI Governor Shaktikanta Das.

MPC composition

Committee changes: The current MPC, which includes three central bank officials and three external members, is set for significant changes this year. The terms of the three external members will conclude on October 6 and cannot be renewed. The MPC is reconstituted every four years, and the government appoints new external members.

Current members

MPC members: The committee includes RBI Governor Shaktikanta Das, whose term ends in early December, Deputy Governor Michael Patra, with a contract until early January, and Executive Director Rajiv Ranjan. The external members are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.

Also read | Finance Bill 2024: Nirmala Sitharaman proposes amendments to LTCG tax provision on immovable properties