March 31, 2023, marks the end of the current financial year and also the deadline for several financial tasks, including linking PAN to Aadhaar, filing updated Income Tax Return (ITR), and paying advance tax. If these deadlines are missed, taxpayers may face penalties. Here are the five financial tasks that need to be accomplished by March 31.

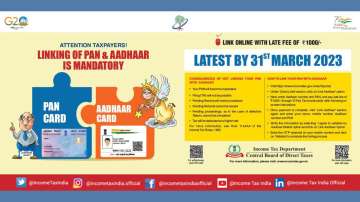

The central government has instructed that Permanent Account Numbers (PAN) must be linked with Aadhaar before March 31st, and failure to do so will result in a penalty of ₹1,000. The Income Tax Department has advised that if the deadline is not met, PAN will be considered 'inoperative' from April 1st.

Taxpayers have until March 31st to file a revised income tax return for the fiscal year 2019-2020, also known as Assessment Year 2020-21. It will not be possible to file the return after the deadline has passed.

According to the IT department, taxpayers must submit the final installment of the advance tax payment for the fiscal year 2022–2023 by March 15, 2023. If a taxpayer fails to make advance tax payments, they will be subject to penalties. The Income-Tax Act mandates that individuals with an anticipated tax liability of ₹10,000 or more after Tax Deducted at Source (TDS) deductions must make advance tax payments.

For the fiscal year 2022-23, taxpayers who have chosen the old tax regime must complete their tax-saving investments before March 31, 2023. The old tax regime allowed taxpayers to deduct various expenses related to their investments.

Lastly, the Pradhan Mantri Vaya Vandana Yojana (PMVVY) is an insurance policy-cum-pension scheme that provides senior citizens with regular income. Investments up to ₹15 lakh can be made by an individual in the scheme. The deadline for making investments in this plan is March 31, 2023.

FAQs:

1. What is the deadline for linking PAN to Aadhaar?

According to guidance from the Income Tax Department, taxpayers must link their PAN with Aadhaar before March 31, 2023. If they fail to do so, they may link them by paying a penalty of ₹1,000. However, if the deadline is missed, the PAN will be considered 'inoperative' from April 1.

2. What is the Pradhan Mantri Vaya Vandana Yojana (PMVVY) and how much can an individual invest in this scheme?

The PMVVY is an insurance policy-cum-pension scheme that provides senior citizens with regular income. Investments up to ₹15 lakh can be made by an individual in the scheme. The deadline for making investments in this plan is March 31, 2023.

Latest Business News