Indian stock market has seen its worst fall ever on Monday. Market benchmark Sensex plummeted over 1,941 points on Monday, wiping off investor wealth worth around 7 lakh crore, following global market meltdown triggered by rapidly-spreading coronavirus and free-fall in oil prices. After sinking over 2,467 points during the day, the 30-share index settled 1,941.67 points or 5.17 per cent lower at 35,634.95.

Likewise, the broader NSE Nifty slumped 538 points or 4.90 per cent to close at 10,451.45.

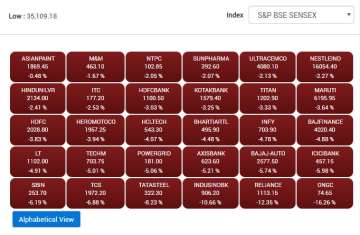

ONGC was the top loser in the Sensex pack, cracking over 16 per cent, followed Reliance Industries, IndusInd Bank, Tata Steel, TCS, SBI, ICICI Bank and Bajaj Auto.

Heavyweight Reliance Industries shed over 12 per cent.

Shares of SBI plunged over 6 per cent after it said it will pick up a 49 per cent stake in Yes Bank for Rs 2,450 crore.

Yes Bank, on the other hand, rallied over 31 per cent.

According to traders, domestic stocks faced massive selloff as the global market rout continued to intensify amid concerns over the adverse impact of rapid spread of coronavirus on the world economy.

Bourses in Shanghai, Hong Kong, Seoul and Tokyo sank up to 5 per cent.

European benchmarks also plunged up to 6 per cent their morning sessions.

Volatility was also fuelled by the sharp plunge in crude oil prices after top exporter Saudi Arabia launched a price war in response to a failure by leading producers to strike a deal to support energy markets.

After tanking up to 30 per cent earlier in the day, Brent crude oil futures recovered marginally and were 18.33 per cent down at USD 36.97 per barrel.

On the currency front, the Indian rupee depreciated 13 paise to 74 per US dollar (intra-day).

Latest Business News