EXPLAINED: Is New Income Tax slab good news for taxpayers?

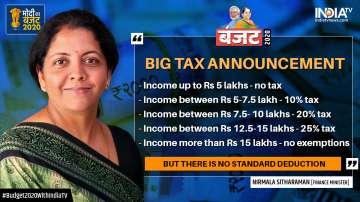

Income Tax Slabs 2020: In what is being considered as a major relief for the middle class, Finance Minister Nirmala Sitharaman on Saturday introduced new income tax slabs and rates in the Union Budget 2020 speech in Lok Sabha. However, is new income tax slabs introduced by Modi govt 'good news' for taxpayers? We try to explain.

Income Tax Slabs 2020: In what is being considered as a major relief for the middle class, Finance Minister Nirmala Sitharaman on Saturday introduced new income tax slabs and rates in the Union Budget 2020 speech in Lok Sabha. However, is new income tax slabs introduced by Modi govt 'good news' for taxpayers? We try to explain.

Citing an example, she said, a person earning Rs 15 lakh per annum would be able to save Rs 78,000 in taxes by opting for the new tax regime.

"A person earning Rs 15 lakh per annum and not availing any deductions will now pay Rs 1.95 lakh tax in place of Rs 2.73 lakh," the Finance Minister said while presenting her second Union budget in the Lok Sabha.

Under the new regime, taxpayers will pay 10%, 15%, 20% and 25% for incomes between Rs 5-7.5 lakh, Rs 7.5-10 lakh, Rs 10-12.5 lakh and Rs 12.5-15 lakh, respectively.

However, is new income tax slabs introduced by Modi govt 'good news' for taxpayers? To understand new tax cuts and its outcome, let's understand new income slabs and old income tax slabs.

Tax Rates for Individuals as per budget 2020-2021

The Minister has proposed a 10 per cent tax on income between Rs 5 lakh and Rs 7.5 lakh from the current 20 per cent now.

Income between Rs 7.5 lakh to Rs 10 lakh will also attract a lower tax of 15 per cent. For annual income between Rs 10 lakh and Rs 12.5 lakh, the income tax rate has been reduced to 20 per cent from 30 per cent.

Those earning Rs 12.5 lakhs to Rs 15 lakhs will pay 25 per cent tax. The Finance Minister said that those earning over Rs 15 lakh would continue to pay the tax at the current rate of 30 per cent.

| Tax Slabs | Current Rate | New Income Tax Rates |

|---|---|---|

| Income upto Rs 2,50,000 | No Tax | No Tax |

| Rs. 2,50,001 - Rs. 5,00,000 | 5% | No Tax |

| Rs. 5,00,001 - Rs. 7.50,000 | 20% | 10% |

| Rs. 7,50,001 - Rs. 10,00,000 | 20% | 15% |

| Rs. 10,00,001 - Rs. 12,50,000 | 30% | 20% |

| Rs. 12,50,001 - Rs. 15,00,000 | 30% | 25% |

| Above 15 lakh | 30% | 30% |

Tax Rates for Individuals as per budget 2019-2020

Income tax slab rates specify the threshold annual income limits at which a higher or lower rate of tax is applicable. There are different tax slabs applicable to the individuals for the financial year 2019-20.

Under existing rules of the Income Tax Act, 1961, resident Indian and non-resident Indians (NRIs) are taxed according to the same tax slabs and rates.

Tax Rates for Individuals as per budget 2019-2020

|

Income Tax Slab (in Rupees) |

Tax Rate for Individual Below the Age Of 60 Years |

|---|---|

|

0 to 2,50,000* |

Nil |

|

2,50,001 to 5,00,000 |

5% of total income exceeding 2,50,000 |

|

5,00,001 to 10,00,000 |

Tax Amount of 12,500 for the income up to 5,00,000 + 20% of total income exceeding 5,00,000 |

|

Above 10,00,000 |

Tax Amount of 1,12,500 for the income up to 10,00,000 + 30% of total income exceeding 10,00,000 |

How much tax you will pay now under new tax regime?

According to new income tax rules,

- Individuals with incomes of up to Rs 5 lakh per year, there will be NO income tax.

- Individuals with incomes between Rs 5 lakh and Rs 7.5 lakh per year, the income tax to be paid will be 10 per cent.

- Individuals with incomes between Rs 7.5 lakh and Rs 10 lakh per year, the income tax to be paid will be 15 per cent.

- Individuals with incomes between Rs 10 lakh and Rs 12.5 lakh per year, the income tax to be paid will be 20 per cent.

- Individuals with incomes between Rs 12.5 lakh and Rs 15 lakh per year, the income tax to be paid will be 25 per cent.

- Individuals with incomes above Rs 15 lakh per year, the income tax to be paid will be 30 per cent.

New tax slabs minus 70 exemptions

Meanwhile, Budget 2020 has offered taxpayers the option to choose between the existing income tax regime and a new regime with slashed income tax rates and new income tax slabs but there are no tax exemptions. Budget 2020 has offered taxpayers the option to choose between the existing income tax and a new regime with slashed income tax rates and new income tax slabs but no tax exemptions.

Therefore, individuals with no housing loan can benefitted under new regime with slashed income tax rates.

It is to be noted that the new income tax rates and slabs will be applicable for those who forego exemptions and deductions. The deductions include- Section 80C, Section 80D, LTA, HRA, interest on home loan on self-occupied property. Individuals can continue to pay at the older rates.

Will taxpayers be benefited by new income tax slabs?

Finance minister Nirmala Sitharaman in her budget speech said that there are about 100 tax exemptions and deductions, out of which 70 are being removed in the new simplified tax regime, while the remaining will be reviewed and examined in due course. Several experts said that it will be 'interesting' to see whether individuals will get net benefit or not.

Why PPF or LIC Policy is not required for tax saving under new Income Tax Regime

Many tax experts believe that whether the new tax slabs will benefit you depends on your tax investments and how much home loan interest you pay. There is definite tax save announcement. In fact, if you may now save tax even without 80C investments like - PPF, LIC Policy, insurance, tax-saving ELSS mutual funds among others.