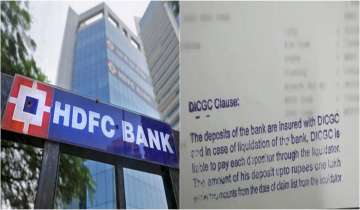

HDFC Customers alert! A passbook picture of HDFC Bank, India one of the largest private sector bank, bearing a stamp of deposit insurance cover being circulated on social media. This HDFC Bank passbook has created concern within the depositors as it informs customers that deposits only up to ₹1 lakh is insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC). Issuing a clarification on it, the lender said the information was not new and has been inserted as per Reserve Bank of India circular issued on June 22, 2017.

Meanwhile, the bank passbook picture has irked concern within the depositors, who feels it is some kind of a warning.

The rubber-stamped message states that “In case of liquidation of the bank, DICGC is liable to pay each depositor through the liquidator the amount of his deposit up to Rs 1 lakh within two months of the date of claim of the liquidator."

HDFC Customers Attention! Bank clarifies on viral passbook pic with insurance deposit stamp

“This pertains to information about the deposit insurance cover. We would like to clarify that the information has been inserted as per RBI circular dated Jane 22, 2017 which requires all Scheduled Commercial Banks, all Small Finance Banks and Payment Banks to incorporate information about ‘deposit insurance cover’ along with the limit of coverage upfront in the passbook,” the bank said in a statement.

“The passbooks without printed information have been have been stamped with the requisite information so as to be fully compliant with extant RBI guidelines,” the statement added.

Concerns over the limit of cover available by banks have increased after the crisis in Punjab and Maharashtra Cooperative Bank exposed.

Last month, RBI had put a slew of restrictions on PMC from all kind of banking operation for six months, citing multicrore scam. RBI had also barred the bank from further lending and accepting fresh deposits.

Initially, it had capped withdrawals at Rs 1,000 per depositor for over six months but later relaxed to Rs 10,000, Rs 25,000 and on Tuesday again relaxed to Rs 40,000.

ALSO READ: Bank of Maharashtra customers? Bank has this important message that you should not miss!

ALSO READ: SBI customer attention! Know how much balance you need to keep in savings account or pay hefty penalty

Latest Business News