Jaitley on 23rd GST Council Meet: '178 items moved from 28% to 18% slab, restaurants flat at 5%; real estate discussion in next meet'

Earlier in the day, the GST Council decided to reduce tax rate on a wide range of mass use items - from chewing gums to detergents -- to 18 per cent from current 28 per cent.

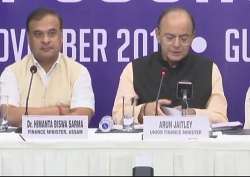

Finance Minister Arun Jaitley on Friday addressed the media after 23rd GST Council Meet in Guwahati in Assam.

Earlier in the day, the GST Council decided to reduce tax rate on a wide range of mass use items - from chewing gums to detergents -- to 18 per cent from current 28 per cent.

The all-powerful council pruned the list of items attracting the top 28 per cent tax rate to just 50 from 227 previously. In effect, the council, in its 23rd meet today, cut rates on 178 goods.

Facing intense heat from opposition-ruled states over keeping mass used goods in the 28 per cent bracket which was meant for luxury and de-merit goods, the Council pruned the list to 50 as against 62 that was recommended by its fitment committee.

Here is the Excerpts from Finance Minister Arun Jaitley's press conference-

# Action against restaurants not an anti-profiteering action, we have changed the mode of taxation, says Jaitley

# Real estate to be discussed in next meeting, says Jaitley

# GST implementation still in a transition phase, the allocation between state and Centre still a challenge, says Finance Minister Arun Jaitley.

# Filing of return for 3B will be continued till March. All tax payers will continue to file 3B till March 2018, says Hasmukh Adhia, Finance & Revenue Secretary after 23rd GST Council Meet

# If there is a nil return to be filed then late filing penalty will be reduced to Rs 20. For others it has been reduced to Rs 50., says Hasmukh Adhia

# Penalty for late filing of GST has been reduced from Rs 200 per day to Rs 50 per day, says Adhia

# 13 items moved from 18% to 12%, 6 items from 18% to 5%, 8 items from 12% to 5%, 6 items from 5% to nil.

# All restaurants in the country to be levied GST of 5%, no ITC benefit to any restaurant.

# Restaurants had a distinction of turnover less than 1 crore, both AC and non AC.

# Outdoor catering rate fixed at 18%

# Restaurants flat at 5% without ITC

# Hotels with Rs 7500 room rent - 18% with ITC

# 178 items moved from 28% to 18% GST slab, changes will be applicable from November 15.

# Aircraft parts, construction materials and other such items to be added in lower categories.

# In the last 3 meetings, we have been systematically looking at the 28% tax bracket and rationalising items out of that bracket, mostly 18% and some even less, says Jaitley

The Goods and Services Tax (GST), implemented "from July 1, has five tax slabs of 0 per cent, 5 per cent, 12 per cent, 18 per cent and 28 per cent.