Wholesale Price Index dips to historic -4.95%; pressure on RBI to cut rate

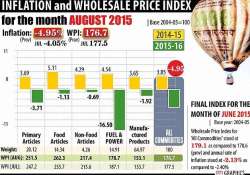

New Delhi: Deflationary trend continued for 10th month in a row with WPI inflation plunging to a historic low of (-)4.95 per cent in August on cheaper commodities, a development that may prompt RBI to

New Delhi: Deflationary trend continued for 10th month in a row with WPI inflation plunging to a historic low of (-)4.95 per cent in August on cheaper commodities, a development that may prompt RBI to cut rates later this month. But for onion and pulses, wholesale prices of most of the food articles either declined or showed a very marginal increase during the month.

Economic Affairs Secretary Shaktikanta Das said there has been a considerable improvement in the price situation. “RBI will take a considered call on the issue. There is no divergence in perception. The government and RBI are working together. Taking into account the overall factors, RBI will take a considered call,” he said.

The Wholesale Price Index-based inflation was (-)4.05 per cent in July. It has been in the negative zone since November 2014. In August last year, it was 3.85 per cent. Inflation in onions and pulses was at 65.29 per cent and 36.40 per cent respectively during August, as per official data released today.

Overall, food inflation basket remained in the negative territory for second month in a row at (-)1.13 per cent. For vegetables, it was (-)21.21 per cent, helped by potato where inflation was (-)51.71 per cent.

Inflation in the fuel and power segment was (-)16.50 per cent, while that of manufactured products was (-)1.92 per cent in August.

Ficci President Jyotsna Suri said “Under the present circumstances, it would be most appropriate for the RBI to give weight to growth considerations and announce a deeper cut in the policy rate”.

The Reserve Bank's next bi-monthly monetary policy review is on September 29. While deciding on the key interest rate it mostly tracks the Consumer Price Index-based inflation, the recent data for which will be released later in the evening. CPI in July was at record low of 3.78 per cent.

Given that CPI inflation has also been declining, RBI needs to reduce interest rates sharply to drive a recovery in demand, industry body CII said.

“We expect the RBI to reduce interest rates by 0.50 per cent in the forthcoming policy with statements supporting further easing in the near future,” CII Director General Chandrajit Banerjee said.

As per the data released today, besides pulses and onion, the food items which got dearer during August are eggs, meat and fish (3.30 per cent), milk (2.08 per cent) and wheat (2.05 per cent).

“The hardening of food prices in August 2015 relative to the precious month was on expected lines, led by onions and pulses, and in sync with the seasonal hardening observed in the past years,” ICRA Senior Economist Aditi Nayar said.

Inflation data for June has been revised to (-)2.13 per cent, as compared to provisional estimates of (-)2.40 per cent.

“Movement of WPI will have an impact on CPI also and chances of a 0.25 per cent cut in repo rate on September 29 has brightened,” India Ratings & Research Chief Economist Devendra Kumar Pant said.

Chief economic Advisor Arvind Subramanian has recently flagged deflationary fears in the economy, while NITI Aayog Vice-Chairman Arvind Panagariya had pitched for cut in policy rate by 0.50 per cent to 1 per cent saying that “this lever” can be used to boost growth.

Growth in the June quarter of current fiscal slowed to 7 per cent, from 7.5 per cent in March quarter of last fiscal.