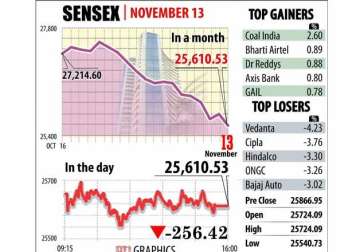

Sensex sees red on downbeat macro data, slips to 2-month low

Mumbai: Rise in inflation and fall in factory output added to the negative market mood as the benchmark BSE Sensex today sinked to a two-month of 25,610.53 by shedding 256.42 points, while selling pressure was

Mumbai: Rise in inflation and fall in factory output added to the negative market mood as the benchmark BSE Sensex today sinked to a two-month of 25,610.53 by shedding 256.42 points, while selling pressure was further exacerbated by fresh worries over global growth.

Domestic shares logged their third weekly fall in a row as the Sensex lost 654.71 points or 2.49 per cent and Nifty dropped 192.05 points or 2.41 per cent during the week.

The short trading week ended on a negative note as two macroeconomic data stoked fears that Indian economy is still not out of the woods.

Industrial production slackened to a four-month low of 3.6 per cent while retail inflation inched up to 5 per cent, government data showed yesterday.

Today's sixth fall in seven sessions was in part a resultof muted global cues, triggered by commodity prices tumbling to multi-year lows. Consequently, massive sell-off was seen in Asian and European markets.

"Bears continue to tighten grip in line with poor global cues, and markets thereby, fell on fears of a rate hike by Fed next month," said Gaurav Jain Director Hem Securities.

The BSE Sensex stayed in the negative zone through out the day and touched a low of 25,540.73 before winding up 256.42 points or 0.99 per cent down at 25,610.53, its weakest closing since September 11.

On Wednesday, the index had risen by 123.69 points in a brief special Muhurat trading session on the opening day of the Hindu year Samvat 2072.

The 50-issue NSE Nifty cracked below the 7,800-mark by plunging 62.75 points or 0.80 per cent to close at 7,762.25.

Read Also: Sensex zooms 200 points in Muhurat trading, Nifty regains 7,800

Intra-day, it hovered between 7,730.90 and 7,775.10.

Stock exchanges were closed yesterday on account of "Diwali Balipratipada".

In individual stocks, Vedanta suffered the most on Sensex by falling 4.23 per cent followed by Cipla at 3.76 per cent.

On the other side of spectrum, shares of Coal India emerged top gainers among Sensex constituents by climbing 2.60 per cent, followed by Bharti Airtel 0.89 per cent.

Overseas, Chinese stocks led decline in Asian equities as a slump in commodities markets deterred investors from riskier assets amid fears of a rate hike by the US Fed by next month.

Key indices in China, Hong Kong, Japan, Singpaore, South Korea and Taiwan dropped by 0.51 per cent to 2.15 per cent.

European markets were also lower as the key indexes in Germany, France and the UK were down in the range 0.11 per cent to 0.46 per cent.

In the domestic market, 22 scrips out the 30-share Sensex ended lower.

Major losers were Vedanta (4.23 pc), Cipla (3.76 pc), Hindalco (3.30 pc), ONGC (3.26 pct), Bajaj Auto (3.02 pc), TCS (2.96 pc), Maruti (2.59 pc), Larsen (2.53 pc), Tata Motors (2.16 pc), ITC (1.66 pc), BHEL (1.50 pc), HUL (1.35 pc), Lupin (1.31 pc), Hero MotoCorp (1.26 pc), SBI (1.25 pc), M&M (1.07 pct) and Wipro (1.05 pc).

However, Coal India rose by 2.60 per cent followed by Bharti Airtel 0.89 per cent, Dr Reddy's 0.88 per cent, Axis Bank 0.80 per cent and GAIL 0.78 per cent.

Among the BSE sectoral indices, capital goods fell by 1.97 per cent followed by auto 1.61 per cent, FMCG 1.50 per cent, Teck 1.36 per cent, IT 1.32 per cent, realty 1.31 per cent, healthcare 0.94 per cent and oil&gas 0.55 per cent while metal rose 0.67 per cent and consumer durable gained 0.20 per cent.

Small-cap and mid-cap indices fell by 1.37 per cent and 0.76 per cent, respectively on selling pressure from retail investors.

The market breadth turned negative as 1,659 stocks ended in red, 934 finished in green while 151 ruled steady.

The total turnover rose to Rs 2,631.54 crore from Rs 696.94 crore on Wednesday.