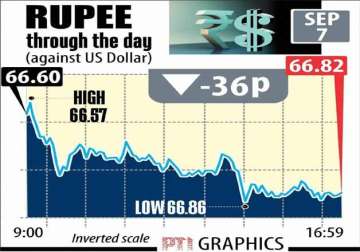

Mumbai: The rupee plunged by 36 paise to close at 2-year low of 66.82 against the American currency today on persistent dollar demand from banks and importers due to sustained foreign capital outflows amidst sharp fall in equity markets.

The domestic currency opened lower at 66.60 as against last weekend's level of 66.46 at the Interbank Foreign Exchange (Forex) market.

It dipped further to 66.86 before concluding at 2-year low at 66.82, showing a loss of 36 paise, or 0.54 per cent. It had last ended at 67.07 on September 4, 2013.

The rupee has dropped 63 paise, or 0.95 per cent, in three trading days.

Forex dealers said volatile domestic equities coupled with higher dollar overseas impacted the rupee sentiment.

The dollar index was down by 0.02 per cent against a basket of six major currencies.

"The USD-INR currency pair will continue to get influenced by global forex and domestic equity moves," a dealer said, adding that exporters are expected to hedge their US dollar receivables on upticks towards 66.86.

Oil prices eased in Asian trade today as dealers await the US Federal Reserve's decision on whether to raise interest rates, following a mixed August jobs report, analysts said.

Meanwhile, the benchmark BSE Sensex ended lower by 308.09 points, or 1.22 per cent, to close below the 25,000-level -- for the first time in 15 months at 24,893.81. Veracity Group CEO Pramit Brahmbhatt said, "The rupee depreciated on cues from weakness in local equities as investors continued to stay away from the uncertain market."

The trading range for the Spot USD/INR pair is expected to be within 66.40 to 67.40, he added.

In forward market today, premium for dollar eased further on persistent receivings from exporters.

The benchmark six-month premium payable in February eased to 205-207 paise from the last weekend's level of 207-209 paise and far-forward August 2016 contracts also moved down further to 420-422 paise from 422-424 paise previously.

The RBI fixed the reference rate for the dollar at 66.7445 and for the euro at 74.2733.

The rupee ended lower against the pound sterling to close at 102.00 as against 101.17 and also fell against the euro to 74.47 from 74.03 previously.

It also dropped against the Japanese currency to finish at 55.96 per 100 yen from 55.77 in the previous session.

Latest Business News