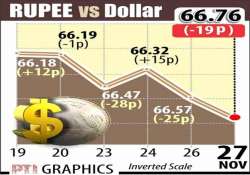

Mumbai: The rupee tumbled by 19 paise to end at more than two-year low of 66.76 against the US dollar on month-end demand for the American currency from importers and some banks.

Besides, persistent foreign capital outflows affected the market sentiment, forex dealers said.

The domestic currency opened lower by 66.66 as against Thursday's closing level of 66.57 at the Interbank Foreign Exchange (Forex) market and dropped further to 66.89 before ending at more than 2-year low of 66.76, showing a loss of 19 paise or 0.29 per cent.

The rupee had last ended at 67.07 on September 4, 2013.

The local currency has dropped 44 paise, or 0.66 per cent, in two days.

It moved in a range of 66.65 and 66.89 during the day.

Dollar index up

The dollar index was up by 0.13 per cent as against the basket of six major currencies in late afternoon trade.

The dollar was nearly unchanged against the yen and the euro in Asian trade on Friday.

With the exception of the Turkish lira, flight to the safety of the dollar has largely subsided following the Turkish military's downing of a Russian fighter.

Attention is now on the European Central Bank's policy meeting on December 3, and the magnitude of potential easing steps, traders said.

Investors have largely factored in a possible US Federal Reserve decision to raise short-term rates in December, but are skeptical about further monetary tightening in the months ahead, they added.

Meanwhile, the benchmark BSE Sensex rose by 169.57 points, or 0.65 per cent, to settle at 26,128.20.

Latest Business News