RBI Asks Govt To Cap Fiscal Deficit

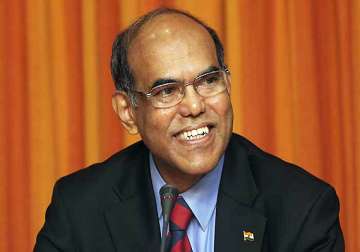

Mumbai, Feb 1: Cautioning the government that excessive borrowing is bad, Reserve Bank Governor D Subbarao today urged the government to put a cap on the public debt as it would hurt growth.“There is an

Mumbai, Feb 1: Cautioning the government that excessive borrowing is bad, Reserve Bank Governor D Subbarao today urged the government to put a cap on the public debt as it would hurt growth.

“There is an inflexion point beyond which fiscal deficits militate against growth. Government borrowing is not bad per se, but excessive borrowing is. There is therefore a need to cap total public debt as a proportion of GDP,” Subbarao said in an address at the International Research Conference here.

The government's fiscal deficit in 2011-12 is expected to exceed the budget estimate of 4.6 per cent of the GDP on account of subdued receipts and overshooting of the subsidy bill by at least Rs 1 lakh crore over and above the original projection.

In order to bridge the receipt-expenditure gap, the government plans to exceed its borrowing target for the current fiscal by Rs 92,000 crore over budget estimate of Rs 4.20 lakh crore.

The RBI had also flagged the issue of rising fiscal deficit at several occasions earlier, including its third quarter monetary policy review in the last week of January.

The government, as indicated by Finance Minister Pranab Mukherjee, is expected to announce steps to contain fiscal deficit in the budget for 2012-13 to be unveiled sometime in March.

Stressing on the need for improving the quality of public expenditure, Subbarao said, “If the government borrows and squanders that money away on unproductive current expenditure, both fiscal sustainability and growth would be jeopardised.”

“Governments need to spend on merit goods and public goods, in particular on improving human and social capital and on physical infrastructure,” he added.

Responding to criticism that the RBI's decision to increase interest rates 13 times since March, 2010, has impacted growth, Subbarao said the policy action was “geared toward safeguarding medium-term growth even if it meant some sacrifice in near-term growth.”

An inflation rate above the threshold level of 4-6 per cent impacts growth adversely, he said, adding, “With inflation ruling above 9 per cent till recently, we were way past the this threshold. At this high level, inflation is unambiguously inimical to growth; it saps investor confidence and erodes medium-term growth prospects.”

In his address, the Governor also called for a clear definition of boundaries for a central bank's responsibility toward sovereign debt sustainability.

A central bank, he said, should take the lead in ensuring financial stability, but not treat it as an exclusive subject.

On the buy-back of gilts to inject over Rs 70,000 crore of liquidity into the system through Open Market Operations (OMOs), the Governor said it was a case of “acquiescence in fiscal dominance”.

He further said, “There is often only a thin line and the interpretation of the motivation for outright OMOs could vary depending on the circumstances.”