Labour Ministry asks EPFO, ESIC not to inspect startups for 3 years

New Delhi: The Labour Ministry has directed retirement fund body EPFO and health insurance provider ESIC to exempt startups from inspection and filing returns for 3 years.In line with Prime Minister Narendra Modi's vision to

New Delhi: The Labour Ministry has directed retirement fund body EPFO and health insurance provider ESIC to exempt startups from inspection and filing returns for 3 years.

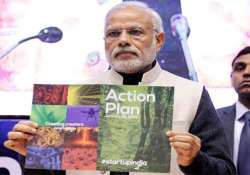

In line with Prime Minister Narendra Modi's vision to nurture startups, the ministry said in a set of directions last week that the new age ventures should be allowed to self-certify their compliance with 9 labour laws.

Labour Secretary Shankar Aggarwal in a letter said startups should not be inspected or asked to file returns for 3 years under 9 laws including Employees' Provident Fundand Miscellaneous Provisions Act and the Employees State Insurance Act.

"Promoting startups would need special hand holding and nurturing. Thus, such ventures may be allowed to self-certify compliance with the Labour Laws," he added.

Read Also: Retrospective tax chapter will never be opened again: PM Modi

They will be exempted from inspection under the Building and other Construction Workers (Regulation of Employment and Conditions of Service) Act, Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, Payment of Gratuity Act and Contract Labour Act.

Startups will also be exempted from filing returns under the Industrial Disputes Act, Building and other Construction Workers Act, Inter-State Migrant Workmen Act, Contract Labour Act, EPF Act and ESI Act.

There will be a blanket exemption from inspection and filing returns for the first year and would be asked to file an online self declaration form.

They will also not be asked to file return or inspected for the next two years, but will be inspected in case a "very credible and verifiable" complaint of violation is filed in writing and the approval has been obtained from the Central Analysis and Intelligence Unit (CAIU), Aggarwal said.

Except the EPF and Miscellaneous Provisions Act and the ESI Act, the implementation of other seven laws lies in both central and state government's sphere.

Labour Ministry had directed its officials as well as the EPFO and ESIC to regulate inspection of startups, under laws which lie in the centre's sphere.