New Delhi: Manufacturing output grew at its slowest place in five months in May on rise in input costs and contraction in demand from abroad, a monthly data showed today adding to the clamour for further rate cuts by RBI.

The data showed the manufacturing to be "barely improving" in further signs of challenging economic conditions prevailing in the sector.

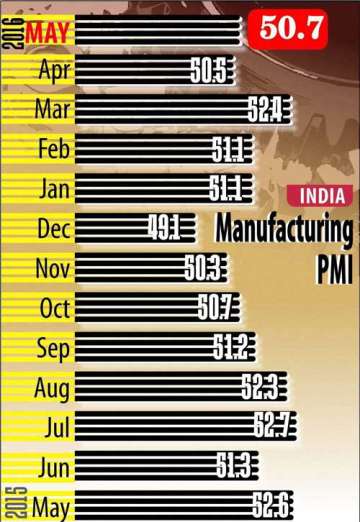

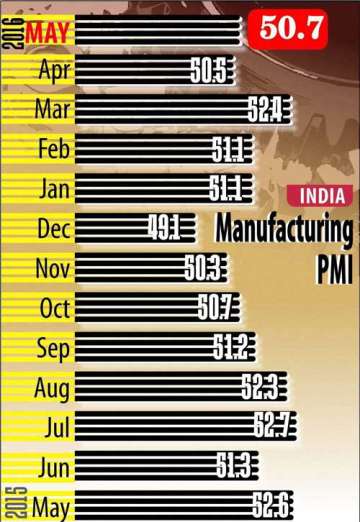

The Nikkei/Markit India Manufacturing Purchasing Managers' Index (PMI) - a composite indicator of manufacturing sector performance, stood at 50.7 in May as against 50.5 in April. A reading above 50 represents expansion, while one below this level means contraction.

This is the slowest growth rate recorded in five months.

Interestingly, the official GDP data yesterday showed that manufacturing sector output grew impressively by over 9 per cent in the fiscal ended March 31, helping the overall economy expand by a five-month high rate of 7.6 per cent.

However, the companies in manufacturing sector have been raising concerns about high input costs and weak demand, especially from overseas markets amid sluggish global economic conditions, and want Reserve Bank to lower the cost of capital by reducing the interest rate.

"Signs of challenging economic conditions in the Indian manufacturing sector were evident in May, with output losing further growth momentum. The headline PMI remained in expansion territory, but recorded one of its lowest readings since the end of 2013, suggesting that the sector is barely improving," Pollyanna De Lima, Economist at Markit and author of the report, said.

New orders expanded but at a "slight pace" and was mostly driven by the domestic market, while new business from abroad fell for first time since September 2013.

"Although new orders rose further, the rate of expansion was well below the long-run survey average and new business from abroad, in fact, declined," Lima added.

As per the survey, subdued demand and an increasingly competitive environment appears to have restricted pricing power among goods producers, as output charges were raised only marginally despite cost inflation climbing to a 14-month high.

"So far, there is little evidence that the latest cut in the benchmark rate acted to significantly improve business conditions for manufacturers. Therefore, further stimulus may be necessary to shift the economy into a higher gear," Lima said.

Earlier in April, the RBI cut its policy rate by 0.25 per cent to 6.5 per cent. While this was the first rate cut after a gap of six months, the RBI has lowered its rate by 1.5 per cent cumulatively since January 2015.

However, the industry still wants further rate cuts from the apex bank to boost investment.

Latest Business News