New Delhi: Markets regulator Sebi has given approval to Hinduja Leyland Finance, an arm of Ashok Leyland, and test-prep player CL Educate to launch their initial public offerings.

The two companies had filed their draft papers with Securities and Exchange Board of India (Sebi) on March 30.

The regulator cleared the proposed initial share sales and gave final observations on the initial public offers (IPOs) on June 24, as per the latest information.

Hinduja Leyland Finance's IPO comprises fresh issue of equity shares worth Rs 500 crore and an offer for sale up to 26,608,810 scrips by existing shareholders.

The company is considering a pre-offer placement of up to 2.6 crore equity shares for an amount not exceeding Rs 200 crore.

Axis Capital, ICICI Securities, SBI Capital Markets and Yes Securities are the merchant bankers for the public issue.

Hinduja Leyland Finance is a part of Hinduja Group which has global presence in automobiles, energy, IT/ITeS, banking and finance, media, entertainment and infrastructure.

CL Educate plans to come out with a public issue of up to 46,90,533 equity shares. This included a fresh issue of 20,60,652 shares and an offer for sale of up to 26,29,881 scrips by existing shareholders.

Proceeds of the issue will be used for acquisitions and other strategic initiatives, repayment of loans, to fund working capital requirements and for other general corporate purposes.

Kotak Mahindra Capital Company will manage the IPO. The city-based firm provides educational services across the value chain including content and infrastructure.

CL Educate had filed its initial papers with Sebi in September 2014 but withdrew the IPO documents in August last year on account of strategic opportunities.

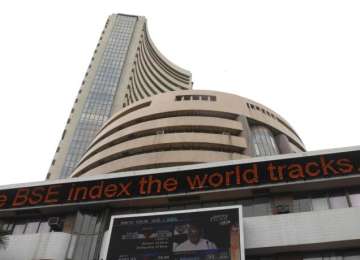

The equity shares of both companies will be listed on BSE and the National Stock Exchange (NSE).

Latest Business News